The medical devices industry continues to be a hotbed of innovation, with activity driven by increased need for homecare, preventative treatments, early diagnosis, reducing patient recovery times and improving outcomes, as well as a growing importance of technologies such as machine learning, augmented reality, 5G and digitalisation. In the last three years alone, there have been over 450,000 patents filed and granted in the medical devices industry, according to GlobalData’s report on Innovation in Medical Devices: Inhalation devices. Buy the report here.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

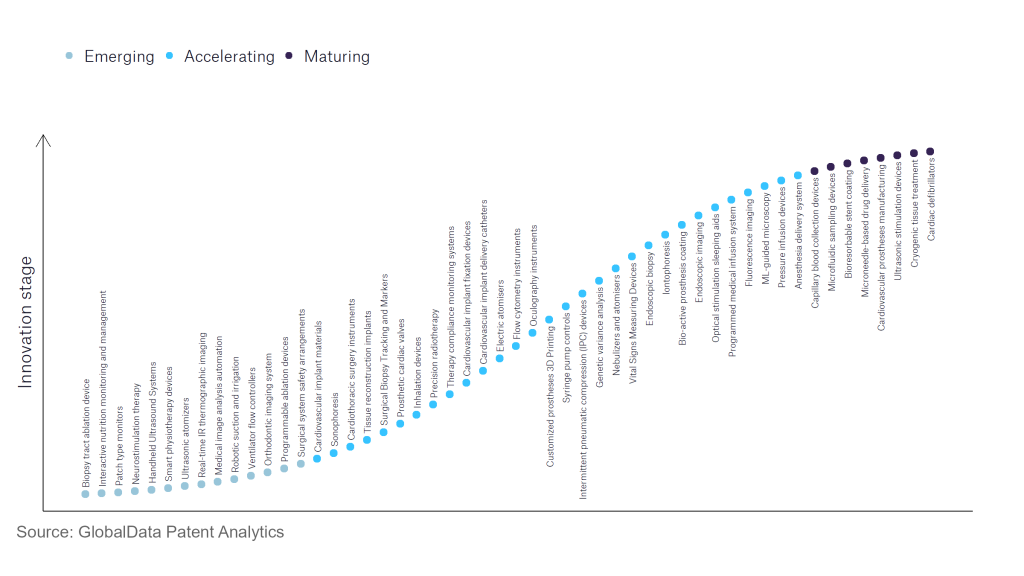

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

150+ innovations will shape the medical devices industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the medical devices industry using innovation intensity models built on over 550,000 patents, there are 150+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, neurostimulation therapy, smart physiotherapy devices, and real-time IR thermographic imaging are disruptive technologies that are in the early stages of application and should be tracked closely. Precision radiotherapy, electric atomisers, and bio-active prosthesis coating are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are bioresorbable stent coating and cryogenic tissue treatment, which are now well established in the industry.

Innovation S-curve for the medical devices industry

Inhalation devices is a key innovation area in the medical devices industry

Inhalers are devices used to deliver medicines to the lungs and airways of patients suffering from chronic respiratory illnesses such as asthma, chronic obstructive pulmonary disease (COPD), and cystic fibrosis. The pressurised metered dose inhaler (pMDI), the dry powder inhaler (DPI), and the soft mist inhaler (SMI) are the three main types of inhaler devices available in the market.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 40+ companies, spanning technology vendors, established medical devices companies, and up-and-coming start-ups engaged in the development and application of inhalation devices.

Key players in inhalation devices – a disruptive innovation in the medical devices industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Chiesi Farmaceutici and AstraZeneca are the leading patent filers in the field of inhalation devices. Some other key patent filers in the field include Teva Pharmaceutical Industries, Syqe Medical and Vero Biotech.

In terms of application diversity, C. H. Boehringer Sohn leads the pack, followed by Niox Group and Chiesi Farmaceutici. By means of geographic reach, AstraZeneca held the top position, with Chiesi Farmaceutici and Galecto in the second and third spots, respectively.

Inhalation devices have been acting as life-saving devices for many decades now. Owing to increased respiratory problems globally, the need for these devices is growing and this trend is expected to continue in the future.

To further understand the key themes and technologies disrupting the medical devices industry, access GlobalData’s latest thematic research report on Medical Devices.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.