The medical devices industry continues to be a hotbed of patent innovation. Activity is driven by increased need for homecare, preventative treatments, early diagnosis, reducing patient recovery times and improving outcomes, and growing importance of technologies such as machine learning, augmented reality, 5G and digitalization. In the last three years alone, there have been over 230,000 patents filed and granted in the medical devices industry, according to GlobalData’s report on Innovation in medical: tissue repair implants. Buy the report here.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

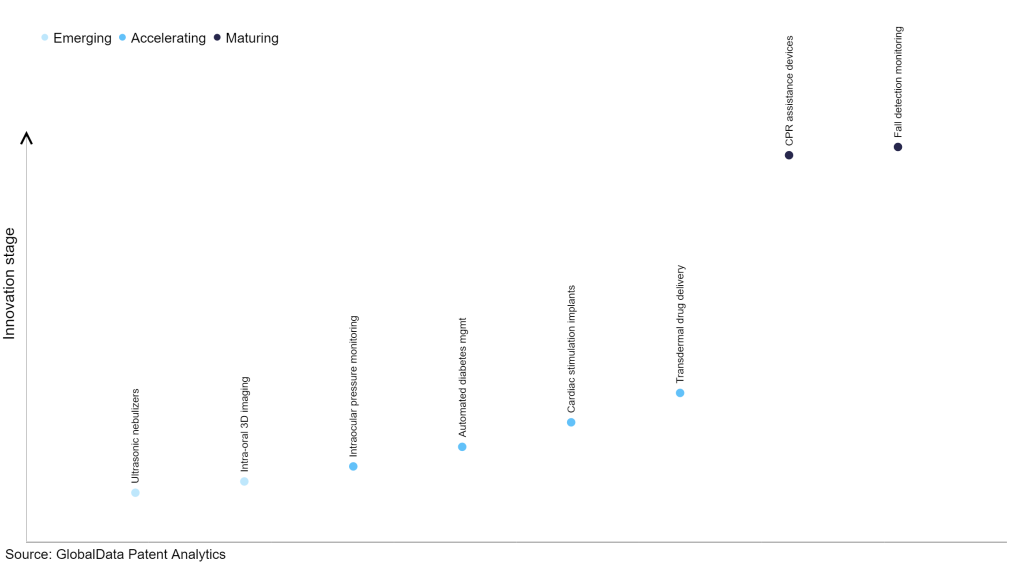

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilizing and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

35+ innovations will shape the medical devices industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the medical devices industry using innovation intensity models built on over 165,000 patents, there are 35+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, ultrasonic nebulizers and intra-oral 3D imaging are disruptive technologies that are in the early stages of application and should be tracked closely. Automated diabetes management, cardiac stimulation implants, and transdermal drug delivery are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas is CPR assistance devices and fall detection monitoring, which is now well established in the industry.

Innovation S-curve for the medical devices industry

Tissue repair implants is a key innovation area in medical devices

Tissue repair implants refer to implantable devices and materials that are designed to facilitate the healing of damaged or injured tissue, such as bone or cartilage. These implants aim to restore normal tissue structure and function, promoting a quicker and more effective healing process.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 220+ companies, spanning technology vendors, established medical devices companies, and up-and-coming start-ups engaged in the development and application of tissue repair implants.

Key players in tissue repair implants – a disruptive innovation in the medical devices industry

‘Application diversity’ measures the number of applications identified for each patent. It broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of countries each patent is registered in. It reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Medtronic and Johnson & Johnson are two of the leading patent filers in tissue repair implants. Some other key patent filers in this field include Stryker, Zimmer Biomet, and Geistlich Pharma.

In terms of application diversity, Orthofix Medical leads the pack, while NanoHive Medical and HD LifeSciences stood in the second and third positions, respectively. By means of geographic reach, GreenBone Ortho held the top position, followed by Baxter International and Orthofix Medical.

With innovations in advanced biomaterials (such as biodegradable polymers, hydrogels, and nanomaterials), 3D printing, bioactive implants, stem cell therapy, and nanotechnology, the adoption of tissue repair implants is expected to increase in the coming years. These developments will significantly enhance tissue repair, offering the possibility of customized solutions, and biodegradability, which reduces the need for removal surgeries.

To further understand the key themes and technologies disrupting the medical devices industry, access GlobalData’s latest thematic research report on Medical Devices.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.