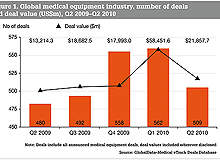

Deal-making activity marginally cooled off in the medical equipment sector in the second quarter (Q2) of 2010. The sector recorded 509 deals worth $21.8bn compared with 562 deals worth $58.4bn in the first quarter (Q1) (Figure 1), a decline of 9% in the number of deals and 62% in value terms.

The in-vitro diagnostic market reported a decline of 42% in the number of deals in Q2, registering 102 deals compared with 145 deals in the previous quarter. However, there was growth in the venture capital segment, which reported 171 deals in Q2 compared with 166 deals in the previous quarter.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

M&A deal value falls

M&A and asset transactions, which include changes in ownership and control of companies or assets, witnessed a huge decrease in deal value to $8.5bn in Q2 from $39.8bn in Q1 2010. Average deal value dropped from $738m in Q1 to $128m in Q2, while the median deal value decreased to $32m in Q2 from $40m in Q1. The abnormal increase in the average deal value in Q1 can be attributed to Novartis and Merck’s separate acquisition deals, which when combined are worth $35.1bn.

The number of M&A deals fell to 78 in Q2 from 110 in Q1. The most active buyers were Essilor International with 14 deals, followed by Covidien with eight. M&A activity is expected to rise because demand for medical devices has the potential to grow as the world’s population ages. The slow stabilisation of the economy will also lead to an increase in M&A activity in the coming years.

“M&A activity is likely to remain subdued for the rest of 2010 due to the economic uncertainties in some of the European economies and slow growth in the US,” says GlobalData analyst Bhaskar Vittal. “Availability of finance becomes difficult during economic uncertainty, leading to low M&A activity. Also, companies will be cautious in their approach to inorganic growth during these periods.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFall in new investments Investments in medical equipment companies, including investments through equity/debt offerings and financing by private equity and venture capital firms, reported a decrease in investments to $13.3bn in Q2 from $18.2bn in Q1. However, the number of deals increased to 291 deals in Q2 from 273 deals in Q1.

On a year-on-year basis, the number of deals and deal value increased by 25%, rising from 233 deals worth $10.7bn in Q2 2009.

Debt offerings reduced

Debt offerings, including secondary offerings and private debt placements, witnessed a decrease in deal value with $7.4 billion raised in Q2 compared with $12.9bn in Q1. Further, the number of debt-offering deals also fell to 18 in Q2 from 22 in Q1. On a year-on-year basis, the number of deals and deal value dropped by 44% and 5%, respectively, falling from 32 deals worth $7.8bn in Q2 2009.

Abbot Laboratories’ raising of $3bn in three separate public offerings of notes and Covidien’s raising of $1.5bn in three separate public offerings of senior notes were the major deals recorded in Q2 2010. Global equity offerings, including initial public offerings (IPO), secondary offerings and private investment in public equities, registered a rise in the number of deals and deal value, reporting 85 deals worth $3.4bn in Q2, compared with 67 deals worth $1.3bn in Q1.

The IPO market gained momentum, rising to nine deals worth $1.9bn in Q2 from five deals worth $287m in Q1.

Venture financing rises

Venture financing in the medical equipment industry witnessed a marginal increase in investments, rising $200,000 to $1.5bn in Q2. Of this, $594m was provided to start-up companies, $377m to growth-stage companies and $487m to later-stage companies. This signifies a more positive short and long-term return on investments expected by venture capital firms with a low-risk appetite. The number of deals also increased from 166 deals in Q1 to 171 in Q2.

The increase in per-capita healthcare expenditure in developing economies such as China and India, alongside the changing regulatory and legislative framework, will provide opportunities for medical device manufacturers to look to these developing markets to supplant their existing international and domestic sales.

North American investments fall

The medical equipment industry in the North American region witnessed a drop in deal value but an increase in the number of deals, with 416 deals worth $13.7bn reported in Q2 compared with 364 deals worth $15.6bn in Q1.

Europe, meanwhile, was able to match the investment of the previous quarter despite the poor performance of public equity/debt market in May and June. The region reported $2.3bn in Q2 compared with $2.4bn in Q1. Asia Pacific, however, registered a staggering 195% increase in deal value, rising to $2.4bn in Q2 from $812.3m in Q1.

Out of economic interest many small clinics and hospitals in China – which has no regulations for governing medical devices – are still using instruments that are not providing accurate diagnoses.

GlobalData expects that there will be a huge opportunity for the elimination of old defective medical devices in the growing Chinese market.

“Investments in North America and Europe may not increase in the near term, as emerging economies in Asia Pacific continue to attract new investments,” says Vittal. “Higher economic growth in countries such as China and India, supported by favourable demographics and a changing regulatory environment, is expected to attract increased investments in that region.”