GlobalData forecasts 189 new medical devices for treating cancer will enter the market or gain regulatory approval during 2018, a significant increase on previous years.

In 2017 130 medical devices entered the market which was only a slight increase on the 119 devices in 2016 but still less than the 143 in 2015. This increase might be driven by technological breakthroughs in in vitro diagnostics (IVD) tests, allowing new gene panel and next generation sequencing tests.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

In-vitro diagnostics tests will continue to dominate the types of medical devices used in cancer treatments, as demand for better biomarker and genetic testing continues to grow. Many tests will continue to use immunochemical techniques but genetic panel and next-generation sequencing will become more common. This is thanks to breakthroughs in reducing test costs for laboratories.

Andrew Thompson, Director of Therapy Research and Analysis within the medical devices team at GlobalData, said: “New laboratory tests will dominate medical devices used in the fight against cancer because of the increased interest in personalised medicine; many new cancer therapies are potent targeted cytotoxic drugs, and it is imperative that the only the most suitable patients receive such therapies. So there is enormous interest in so-called Companion Diagnostic tests; blood tests that are specifically linked to a particular drug for prescribing purposes. Such tests have become essential for prescribing and reimbursement, raising their importance, and also providing a potentially lucrative revenue for IVD manufacturers.

“Also regulations are pushing the development of new IVD tests; the FDA has informally told the industry that the prospects of a successful new drug approval are substantially improved if a companion diagnostic test is included as part of the clinical trial. In effect, any new drug – especially cancer drugs – on sale in the US will require a companion diagnostic or IVD test.”

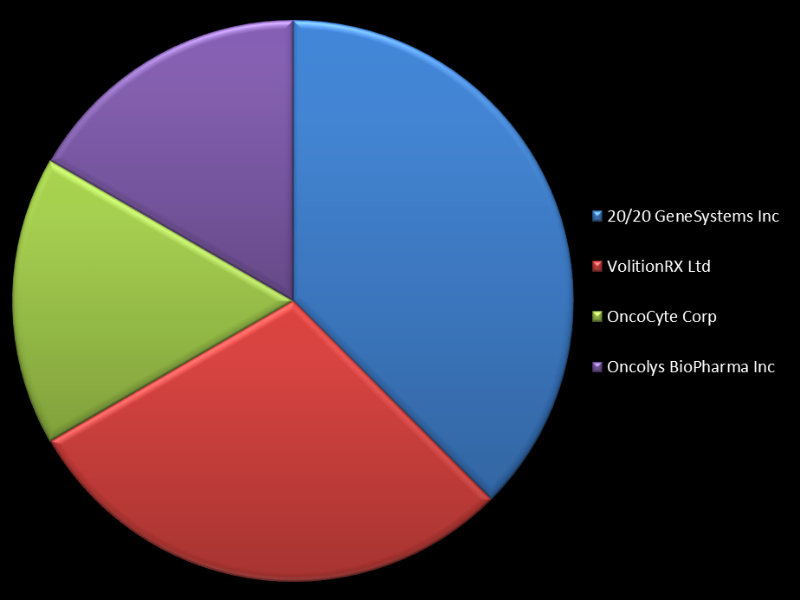

20/20 GeneSystems has the most multiple cancer therapy devices expected to be approved this year, with a total of nine in the pipeline. It is closely followed by VolitionRx, which has seven cancer devices awaiting release. Other companies with numerous devices in production include OncoCyte, Oncolys BioPharma, ProteoMediX, Roche Diagnostics, TrovaGene and Nanobitotix.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe cancers continuing to attract the most interest amongst medical device manufacturers are lung cancer, breast cancer, prostate cancer and bowel cancer. They are also referred to as the ‘big four’ cancers because of their commonality. Cancers with a lower incidence include gastrointestinal, oral, soft tissue and urothelial cancer. The varying levels of complexity in treating certain cancers do not appear to affect the manufacturers’ interest when they choose a type to focus their technology development on.

Thompson characterised the types of devices, saying: “Most of the devices are new in vitro diagnostic devices, or new lab tests, and these are used to either diagnose cancer, or to allow prognostics; the further characterisation of the cancer that will allow the selection of the most appropriate cancer.

“For FDA-approved tests, in general, the FDA is looking for performance that is substantially equivalent or better than what already exists. Even for new tests that have no competitor, they will be requiring a high degree of specificity and sensitivity, so these tests will definitely provide an improvement on current solutions, and in some cases, there will be no current test. In Europe, for marketing purposes, new tests don’t have to show such benefits, but in practice, physicians will be looking at the hard evidence before prescribing.”